Our Content

Listen, Learn, & Unlock

For most of the high-impact strategies we use across tax, estate, and financial planning, there’s a podcast episode to match—and we can even create a custom playlist tailored to your goals, so you can dive into what matters most to you. If something you read or hear sparks an idea, we’re happy to walk you—and your other trusted professionals—through how it applies to your situation, completely free of charge.

Case Studies

WB7 Roth Conversion for Business Owner Results in Multi Generational Wealth

WB Special Stop Paying a Premium for Terrible Investment Management

Wealth Breakdown: Vistage Chair

Our Blog

May 12, 2025

What I Read This Week May 12th, 2025Billy Amberg4 days ago1 min readClick here to talk to Bloomwood about your finances.PodcastDoug Burgum, Secretary of the Interior | All-In DCBrooke Rollins, Secretary of Agriculture | All-In DCTrump's First 100 Days, Tariffs Impact Trade, AI Agents, Amazon Backs DownBlackstone's King of Hedge Funds on Alt Investing Right NowHow Andreessen Horowitz Disrupted VC & What’s Coming NextThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

May 5, 2025

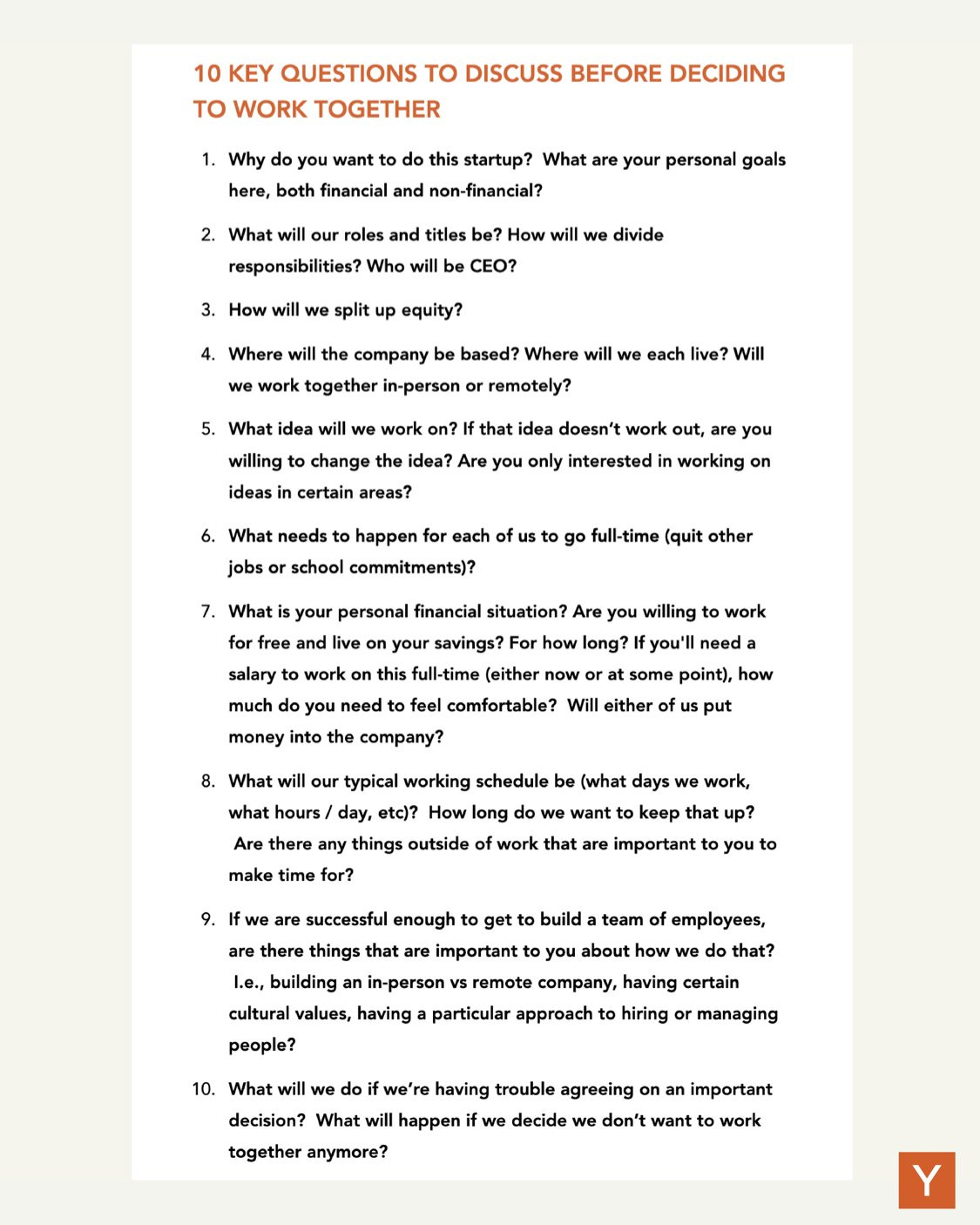

What I Read This Week (5/5)Billy AmbergMay 5, 20231 min readNever Split the Difference (Chris Voss) Improve your outcomes. Learn from former FBI lead hostage negotiator Chris Voss.Case Studies From Principles for Navigating Big Debt Crises (Ray Dalio)Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House The 10 most important questions you should discuss with potential co-founders before deciding to work together:

May 3, 2025

What I Read This Week May 3rd, 2025Billy AmbergMay 51 min readClick here to talk to Bloomwood about your finances.XWho are the top companies that do LLM-SEOApple in willful violation of this Court’s 2021 InjunctionNorthern District of California court has ruled on the Epic v Apple anti-steering injunction’s contempt of court proceeding!Something is seriously wrong hereThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

April 21, 2025

What I Read This Week Apr 21st, 2025Billy AmbergApr 211 min readClick here to talk to Bloomwood about your finances.XI think marijuana is the most insidious of drugsI had a child “diagnosed” with ADHD several years agoLinkedInIRA ALERT - TRUMP ADMIN FLOATS A 39.6% TOP INCOME TAX RATE VERSUS 37.0%PodcastMacroVoices #475 Simon White: The Dawn of A New Financial OrderThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

April 17, 2025

What I Read This Week (4/17)Billy AmbergApr 21, 20231 min readOnly 7% of Harvard freshmen planned to major in the humanities, down from 20% in 2012, and nearly 30% during the 1970s. Tesla Q1 Earnings Call and Q&A AI Regulation. I think this is the right way to think about it, though I don't agree that it has to be the government. It could be self-regulatory....might be wishful thinking.The dark side of using AI to design drugs 20VC: Who Wins in AI; Startup vs Incumbent, Infrastructure vs Application Layer, Bundled vs Unbundled Providers | From 150 LP Meetings to Closing $230M for Fund I; The Fundraising Process, What Worked, What Didn't and Lessons Learned with Tomasz Tunguz MacroVoices #372: The Bear Market Bottom is Not In David Sacks on his intellectual and political journeyMarc Andreessen on his intellectual journey the past ten years

April 14, 2025

What I Read This Week Apr 14th, 2025Billy AmbergApr 141 min readClick here to talk to Bloomwood about your finances.XI still don’t understand why no one is taking the social security buyout idea seriouslyLinkedInDon't Make the Mistake of Thinking That What's Now Happening is Mostly About TariffsArticlesRegulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade DeficitsGenerative AI use surging among consumers for online shoppingMitochondria transplants could cure diseases and lengthen livesPodcastDOGE updates + Liberation Day Tariff Reactions with Ben Shapiro and Antonio GraciasThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

April 10, 2025

What I Read This Week (4/10)Billy AmbergApr 14, 20231 min readAll In 123 - Trump indictment, de-dollarization, should VCs back Chinese AI? RIP Bob LeeAll In 124 - AutoGPT's massive potential and risk, AI regulation, Bob Lee/SF updatePrinciples for Dealing with the Changing World Order, Ray Dalio Principles for Navigating Big Debt Crises, Ray Dalio San Francisco is Falling Apart BBC Embarrassed An Idea for Social Media Features Macrovoices 371 - Fed will be forced to cut by the end of the year.How The Best Investors Obsess Over Interest Rates (The Pomp Letter)The Gambler Who Beat Roulette (Bloomberg)Why journalists can't quit Twitter (Platformer)Industrial policy doesn't have to succeed right away (Noahpinion)How The Best Investors Obsess Over Interest Rates (The Pomp Letter)Google reveals its newest A.I. supercomputer, says it beats Nvidia (CNBC)Tim Cook on Shaping the Future of Apple (GQ)Jerry Brown Is Angry: Why Is America Barreling Into a Cold War With China? (Politico)In Croatia, U.S. Campaigned to Stop Chinese Bid on Key Port (WSJ)Downtown San Francisco Vacancies Hit Record High as City Nears Breaking Point (SF Standard)Clarence Thomas and the Billionaire (Pro Publica)How long does it take to build a nuclear reactor? (Hannah Ritchie)It’s raining seeds (Coral Carbon)Big If True: Quantum Computers (Cleo Abram)

April 7, 2025

What I Read This Week Apr 7th, 2025Billy AmbergApr 71 min readClick here to talk to Bloomwood about your finances.LinkedInBREAKING - DOJs SEEKS INJUNCTION AGAINST MONETIZED INSTALLMENT SALEXSmall Modular Reactors will be crucial in powering sitesWe knew very little about how LLMs actually work...until now.The biggest SEO opportunity of this decade is invisibleThe Complete United States Reciprocal Tariffs ListThe Effects of Tariffs: How the Machine WorksBessent got his wish.Trump’s new tariffs aren’t a trade tweakThe Consequences of Liberation Day1996 Nancy Pelosi encourages all of Congress to back reciprocal tariffsThe language of Trumps post here is very importantPeople are yet to understand that we have a macro hedge fund manager running the TreasuryThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

March 31, 2025

What I Read This Week Mar 31st, 2025Billy AmbergMar 311 min readClick here to talk to Bloomwood about your finances.Podcast"Bill Burr"White House BTS, Google buys Wiz, Treasury vs Fed, Space RescueHoward Lutnick | All-In in DC!Is There an Extremely Simple Fix for Affordable Housing?20VC: Why Traditional VC is Broken: How VCs Learned Nothing from 202120VC: Microsoft CTO on Where Value Accrues in an AI World | Why Scaling Laws are BS#922 - Naval Ravikant - 44 Harsh Truths About Human NatureThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World

March 24, 2025

What I Read This Week Mar 24th, 2025Billy AmbergMar 171 min readClick here to talk to Bloomwood about your finances.XThe most dangerous, oddly glorified, yet overlooked problem in the worldHe deleted almost every app from his phonePodcastHoward Lutnick | All-In in DC!TSMC Founder Morris ChangThe Hidden Globe: How Wealth Hacks the WorldTe Hidden Globe: How Wealth Hacks the World